Stock trading is back but no one is charging for it, thanks to millennials

Pedestrians pass in front of a Charles Schwab bank branch in downtown Chicago, Illinois.

Christopher Dilts | Bloomberg | Getty Images

Brokerage firms won’t profit off the recent rise in stock trading the way they have historically. Millennials might be the reason.

Industry leaders including Charles Schwab and Fidelity adjusted from around $5 per trade to zero commissions in October. Analysts say they had no choice if they wanted to get a younger generation of novice traders who grew up being offered products from Facebook to YouTube for free.

“The impetus behind this was Schwab and other discount brokers seeing saturation at the current level of investors,” said Stephen Biggar, analyst at Argus Research. “They’re trying to get the next layer of investor and making it easier for them to invest.”

That next “layer” had been increasingly turning to newer trading sites like Robinhood. The zero-fee stock trading start-up was able to bring in more than 6 million customers, and a $7.6 billion valuation, by offering free stock trading. Student loan start-up SoFi, and more recently Square, also offer free stock trading. Biggar said the older firms were “watching from a distance” and “started to take more notice” as soon as start-ups reached a certain level of client.

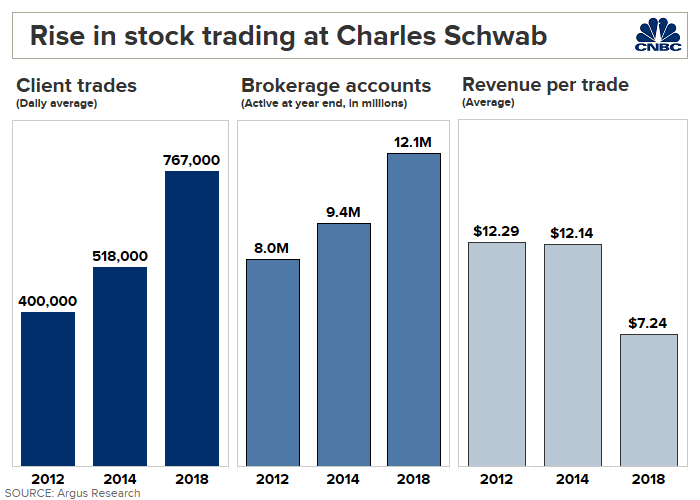

The rise in trading

Retail trading has taken off in the past decade.

Average daily client trades at Charles Schwab nearly doubled from 400,000 six years ago to 767,000 in 2018, according to Argus data. Active brokerage accounts have also nearly doubled. But revenue per trade has gone in the other direction, from $12.29 to $7.24 during the same time frame.

Richard Repetto, principal at Sandler O’Neill, said the increase in trading is thanks to a record bull market, modest volatility and ad spending by the brokerage firms. Pricing of trades had been going down for 20 years, but Repetto said analysts “didn’t think zero would come this quickly.”

“Trading has been growing — the more difficult thing has been what firms make on it,” Repetto told CNBC. “It’s getting more competitive and they don’t want to lose the next generation.”

Shares of the major brokerage firms plummeted after the announcement they were going to zero, mostly because of the chunk of revenue they were walking away from. At TD Ameritrade, commissions made up 25% of annual revenue and 16% of E-Trade, according to JMP Securities. For Schwab, it was 7% of annual revenue. Commissions fed about $90 million to $100 million in quarterly revenue, according to Schwab’s chief financial officer.

But firms are now leaning on other sources of revenue.

Paying for free trades

Brokerage firms make money off interest on customer account balances and margin lending. By getting additional younger traders on the platform, they can make more off securities lending and spreads on invested balances. Many also make money off payment for order flow — selling customers’ trades to high-frequency traders. Interactive Brokers said it would use payment for order flow to subsidize free trades.

“As long as free trades get people in the door, they can profit in other ways,” Argus’ Biggar said. “Zero fees encourage people to stay put — it’s as much about housing the money and getting spread on invested balances.”

Many of these firms also offer the ability to buy less than full shares to encourage first-time traders who might not otherwise be able to afford expensive but popular retail stocks like Amazon and Apple. Schwab was the first major brokerage to offer so-called fractional trading, which the firm said was aimed at attracting younger first-time traders.

Fintech players aren’t necessarily looking to free trades as a money-marker, either.

On its latest earnings call, Square CFO Amrita Ahuja said trading increases “stickiness” on the platform. She said they learned from habits around bitcoin trading, which the company launched in 2018. Users who traded cryptocurrency on Square’s Cash App were significantly more active on the service.

“We see it as an engagement driver at this point in time because we launched with no commissions,” Ahuja said in a phone interview. “It improves the daily utility of our app and enable us to efficiently cross-sell features that can be monetization drivers.”

If history is any indication, the move to free trades may also drive stock market activity.

UBS senior equity research analyst Brennan Hawken said trading volume will likely pick up, even if it’s “temporary.” In the six months after the last round of commission cuts, Hawken said the major firms have historically seen an acceleration in account growth, often linked to trading volume. Having zero fees, and the advertising brokerage firms do around it, “reminds people to trade,” he said.

But Hawken wasn’t applauding the decision to slash fees. The idea that fintech companies like Robinhood were a threat was “bad judgment” by the leaders, he said.

“It’s a negative for the industry,” Hawken said. “The industry just burned hundreds of millions of dollars. It was a value-destructive move and seems completely unnecessary.”